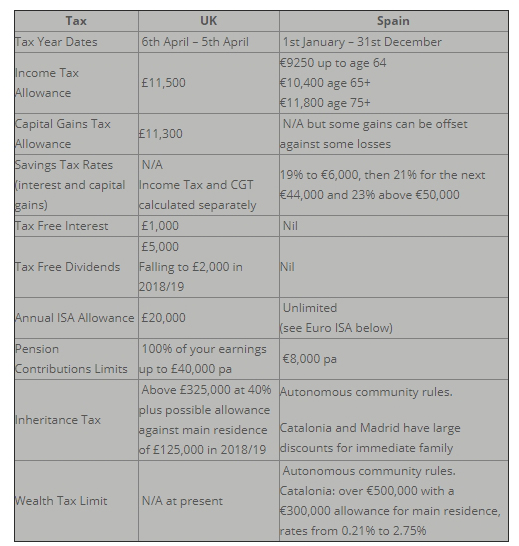

This is an introduction to the differences between the UK and Spanish tax systems and an introduction to a European ISA equivalent. It has been produced to help answer two regularly asked questions. : “What is the difference in taxation between Spain and in the UK?” – followed by “Is there a tax free savings account in Spain similar to an ISA?”.

For those of you not from the UK, I hope that the Spanish part of the table below will still be useful in allowing you to compare it with your home country tax situation.

The main differences are in Wealth Tax, Inheritance Tax and the way savings are taxed.

Wealth Tax in Spain

In the UK there is not currently any Wealth Tax. There is in Spain and the rates and method of calculation are set by the autonomous communities. In Catalunya the rate is banded, starting at 0.21% and rising to 2.75%.

Inheritance Tax in Spain

In the UK, the estate of the deceased person is taxed as a whole, whilst in Spain, the person receiving the bequest is taxed based just on the amount they personally receive from the estate. The allowances and method of taxation also differ. The rates of inheritance tax in Barcelona and the Costa Brava are the same but will be very different if you live in Andalucia. For more information, please see Inheritance Tax in Catalunya as an example.

Tax Free Savings in Spain

In the UK, since January 1987 with the introduction of Personal Equity Plans (PEPS), we have been used to having tax free savings. Peps are now called ISAs and the allowance is now £20,000 per annum. If you live in Spain and have an ISA please note it is taxable in Spain. The fact that it is tax free in the UK does not transfer to Spain and you should look at the alternative below.

Spain does not have an ISA system as such but there is a similar investment, sometimes known as the “European ISA”. It is tax free whilst invested and has a very beneficial low taxation basis, especially if you require income from your investment. It is a little more restrictive than the UK ISA but is still worthwhile.

The two big advantages are that there is no limit and it is portable to other countries. If you would like to invest 10,000,000 euros in one year in the “European ISA” you can do! Unlike a UK ISA, the European ISA can go with you if you move country (not to all countries). If you return to the UK, the tax will be proportional to the amount of time you have been in the UK against the time you have had the European ISA. So if you have a Euro ISA for 10 years in total and have moved back to the UK for the last two years of the 10 years, the tax will be reduced. Specifically, the tax will be calculated and multiplied by 2/10ths. An 80% tax saving!