There was no shortage of market drama in 2022. Real pain was inflicted as investors saw the fantastic returns (fuelled by post-Covid enthusiasm) drained from their portfolios when stock markets went into free fall at the start of the year. The drama is understandable. Instability grips the world as the pandemic lingers, inflation swells, violence against Ukraine rages, an energy crisis looms and China looks to avoid further lockdowns. The supply-chain bottlenecks that were expected to have straightened themselves out remain somewhat entangled. Consumers are still buying, but their confidence is falling as interest-rate rises and higher inflation start to squeeze their finances. Those who previously boasted about their big returns in crypto are probably now less verbal as we saw a massive decline in Bitcoin (down 64%) and Ethereum (down 66%) in 2022.

And yet…all isn’t lost. There are reasons for optimism…

At the top of the list is the fact that much of the bad news is out and probably priced into the stock market already. Also, there are common themes to falling markets that, instead of flashing warning signs, can signal buying opportunities. That said, 2022 has brought some surprises …

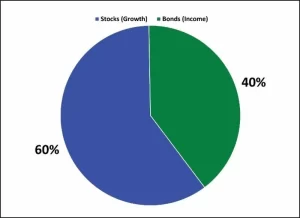

When stocks fall bonds rise right? … not in 2022! Why the 60/40 portfolio struggled in 2022!

Contrary to the widely held historical view that fixed-income holds up better in tough environments, bonds were decimated in 2022 by rising interest rates. The 10-year US Treasury note clocked its worst performance in 234 years. As a result, the classic spread of 60% stock/40% bond retirement portfolio did very little to insulate on the downside.

Investment strategies don’t get more classic than the so-called 60/40 allocation. By holding 60% of your portfolio in stocks and 40% in bonds, the idea is that you get the best of both worlds: high growth potential from your riskier stocks and protection from your more conservative bonds.

However, for investors who hold this portfolio mix or one similar to it, 2022 was tough. The problem is that bond prices and interest rates move in opposite directions, so as interest rates have risen bonds have fallen; if your portfolio is aligned to the traditional 60/40 split you’ve probably seen a dramatic drop in your whole portfolio as equities AND bonds have suffered. From the start of 2022 a 60/40 portfolio invested in line with benchmark US stock and bond indexes lost 20%. Only two calendar years, both during the Great Depression, have been worse.

The 60/40 portfolio is designed for moderate risk and moderate returns, so is a typical spread for a ‘balanced’ investor. This strategy relies on the fact that while the stock market periodically goes down, and the bond market periodically goes down, they rarely go down at the same time – known as low (or negative) correlation. Whilst this has worked well for investors for the past two decades, 2022 gave many investors (and their advisers) another lesson … what has worked well in the past doesn’t necessarily hold good for the future when it comes to investments!

For me the 60/40 portfolio has felt dated for some time, and as a business we moved away from this strategy over five years ago. We focus on other ways of bringing stability to our clients portfolios through greater diversification than a simple 60/40 split, whilst at the same time reaching for potential outperformance with tactical equity holdings, ensuring individual portfolios are aligned to each clients attitude to risk, their goals and their life stage. This strategy has proved successful for our investors in the storms of 2022 and has helped us to lessen the sharpness of this year’s dips.

Second, we need to understand that often everyone agrees but nobody actually knows! Widespread consensus must always be taken with a grain of salt. Although widely anticipated, the pandemic-induced slowdown that was declared in 2020 defied all expectations by lasting just a couple of months – well short of the two quarters of negative growth normally associated with recessions. The most recent substantive recession was 15 years ago – triggered by the global financial crisis, lasting between one and two years and earning the label of the Great Recession because of its severity and length.

Taking Stock – will 2023 be any better?

For those above a certain age who may remember this song being released in 1977 (I was age 10😉) … I’m not talking about sex, drugs and rock’n’roll!

Focusing on the next five to 10 years, not the next five to 10 months with your investment outlook, is more productive and is likely to be more profitable. While today’s market storms continue, the unemotional investor who has the self-restraint needed to drown out the noise and bear the near-term pain is likely to reap significant long-term gains!

Typically, two of the best indicators of future investment returns are the price an investor pays for their investment funds and the level of diversification within a portfolio. The storms we’re currently enduring are serving up great opportunities to load up on wonderful businesses, and hence the investment funds that hold them, at bargain prices. Once the storm passes, patient investors are likely to be rewarded as the markets charge forward once again.

Many investors will not only have celebrated Christmas and the New Year, but are likely to be welcoming the end of 2022 in respect of their finances, which has proved to be brutal for investors and borrowers alike.

Moving on to my thoughts for 2023, I think we can be cautiously optimistic for the following reasons:

Inflation: It seems like we’re finally starting to turn a corner, it will have taken big rate hikes, and we could certainly see a recession in 2023 as a result, but I think we’ll have a ‘mission accomplished’ moment at some point in 2023.

Interest rates: There are some big catalysts that could lead to much lower mortgage rates at this time next year, such as a recession, a general lack of demand for loans, and the possibility of cooling inflation. In the short term we are likely to see further rate rises, but as inflation is brought back under control and economies weaken, by the end of 2023 we may see interest rates starting to fall again.

Stock markets: Keep in mind that the stock market is forward-looking. The markets have had a terrible 2022 not necessarily because of what happened in 2022, but because markets anticipated a recession, long-lasting high interest rates, and inflation. If inflation is brought back under control and interest rates start to come down, stock markets could have an excellent 2023.

The key is to make sure your portfolio is well positioned to take advantage of the current discounts and growth when it comes.

On that note I will finish by wishing you all a happy and prosperous New Year. I hope that 2023 brings you good health and happiness.

This article was kindly provided by Andrea Speed from Speed Financial Solutions and originally posted at: https://www.speedfinancialsolutions.com/post/2022-in-review

The above contents and comments are entirely the views and words of the author. FEIFA is not responsible for any action taken, or inaction, by anyone or any entity, because of reading this article. It is for guidance only and relevant professional advice should always be taken before investing in any assets or undertaking any financial planning.