Around the world billions of people are affected by one of the worst health crises of the past century. The global economy is under pressure in ways not seen since the Great Depression in the 1930s; businesses are failing and unemployment is surging. Confinement measures are in place in 187 countries and territories, and although they vary in scope, activity in the transportation sector has fallen dramatically almost everywhere.

Around the world billions of people are affected by one of the worst health crises of the past century. The global economy is under pressure in ways not seen since the Great Depression in the 1930s; businesses are failing and unemployment is surging. Confinement measures are in place in 187 countries and territories, and although they vary in scope, activity in the transportation sector has fallen dramatically almost everywhere.

Even assuming that travel restrictions are eased in the second half of the year, global oil demand is expected to fall to a level in 2020 that erases almost a decade of growth.

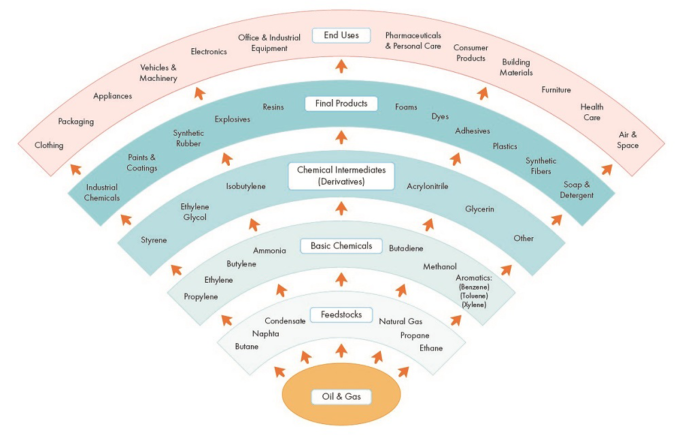

As an Investment Adviser, understanding more about how we use oil and the impact it has on industry worldwide, and ultimately, how that could affect investment returns is crucial. Transport is an obvious industry, but there are many others less obvious.

‘Because we are now running out of gas and oil, we must prepare quickly for a third change, to strict conservation and to the use of coal and permanent renewable energy sources, like solar power.’ (JIMMY CARTER, televised speech, April 18, 1977) … and here we are in 2020, oil remains such an integral part of so many of the products that we use on a daily basis, it could be said that we are the addicts and the oil producers are the pushers!

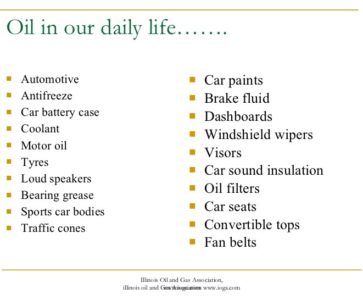

Let’s drill a bit deeper and look at the detail of just one of those ‘end uses’ of oil mentioned above. Vehicles contain more oil than you might think …

The price of oil has fallen from a high of $164 USD a barrel in June 2008, to under $20 USD a barrel earlier in 2020 (albeit it has bounced back to around €40 USD since). The drop in oil prices that started in 2008 took place against the backdrop of the Global Financial Crisis. Economies all around the world sputtered to a halt, and demand for oil dropped. Whilst the worst of the recent oil price crash appears to be in the rear-view mirror, what does the future hold for oil? JP Morgan are predicting that it will shoot up to over $100 USD a barrel in the near future due to the cyclical nature of the oil industry, believing it could hit $190 USD a barrel by 2025.

The forecast is not without a logical basis. The way cyclical industries work is that the industry produces a lot of the commodity when there is a high demand for it. Eventually, supply begins to outpace demand for one reason or another. Prices then fall, the industry retreats and shrinks production to limit supply and stimulate higher prices. This brings a deficit of the commodity, which pushes prices up. This cycle repeats once every few years.

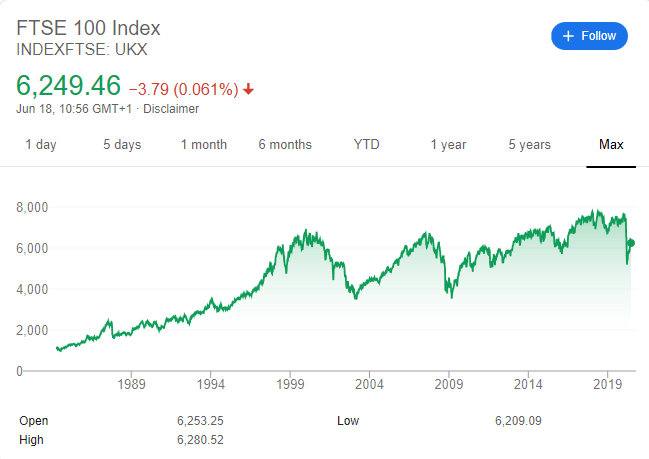

This chart shows the oil price over the last 20 years. As you can see, the price of oil today is not dissimilar to the price back in 2000. The chart below shows the FTSE 100, in the same period the FTSE 100 is now currently below 2000 levels …

The crisis goes on, and much of the world remains in lockdown as the coronavirus continues to impact nearly every aspect of society. Financial markets, however, appear to have stabilized and perhaps are looking to the future. Long‑term Implication? The coronavirus and the resulting focus on countries being able to be more self‑sufficient seems set to accelerate the de‑globalization trend.

One outcome of recent events is the question of supply chain security and the reliance on non‑domestic production to meet the needs of society, especially in times of crisis. Think ventilators, personal protection equipment, and hand sanitizer and the struggles of individual governments to provide enough of these products. The experience of medical equipment shortages, along with the existing US‑China friction, will make self‑sufficiency a more important part of economic policy.

The outlook for global equities is still highly uncertain given the possibility of further drawdowns. No one rings a bell to signal the bottom of the market!

In our portfolios, we haven’t been hiding in defensive areas. We do include some defensive holdings but build on that with tactical equity holdings. We’ve been monitoring how our portfolios are reacting in this unchartered territory and due to the diversification and tactical equity holdings I am pleased with how they have held up. Some of our tactical holdings, including technology, are showing fantastic returns even in the current dip.

I believe that the world is gearing for a long‑term change where people travel less and technology is adopted more. A google search to find out how people are using technology revealed interesting results. This is a list of the words used in google searches from around the world so far in 2020 …

There is no doubt that technology is playing a major part in the future, with over 275 million Amazon searches so far this year, it’s clear to see that the coronavirus has resulted in a lot of online shopping! With Netflix searches at 176 million, we can see how families have been spending lockdown!

Longer term, there are real and unanswered questions of how governments will finance stimulus packages and how rising debt levels can be serviced. There is no doubt that the global economy will enter a recession in the first half of 2020. The total halt to business worldwide to stem the spread of the virus is too powerful a force for economies to be able to withstand without a significant impact. But this will be a different kind of recession. This is brought about by a natural disaster, not a debt crisis or an economic or stock market bubble. With low inflation and near zero interest rates around the world set to continue, we may well see a fairly rapid recovery.

Despite the near‑term uncertainty, I feel optimistic over the medium term (12–24 months) that a new bull market can potentially be born from equity valuations that are lower, as we see stabilisation and then normalisation of economies.

Historically, the US is not afraid of making tough decisions and acting quickly to stimulate its economy. Amid the worst job market in decades and projections that the economy will contract by as much as 35% this quarter, entrepreneurs apparently missed the message of doom. New business formation in the US has rebounded quickly in parts of the country, raising hopes for a stronger-than-expected recovery. If there is a new bull market, I believe it will start in the US and filter through to other countries over time.