When it comes to keeping on top of your financial situation and all associated tasks, it can easily feel overwhelming. However, if you break it down month-by-month and focus on one thing at a time it’s less daunting and more manageable. Think of it like a financial checklist.

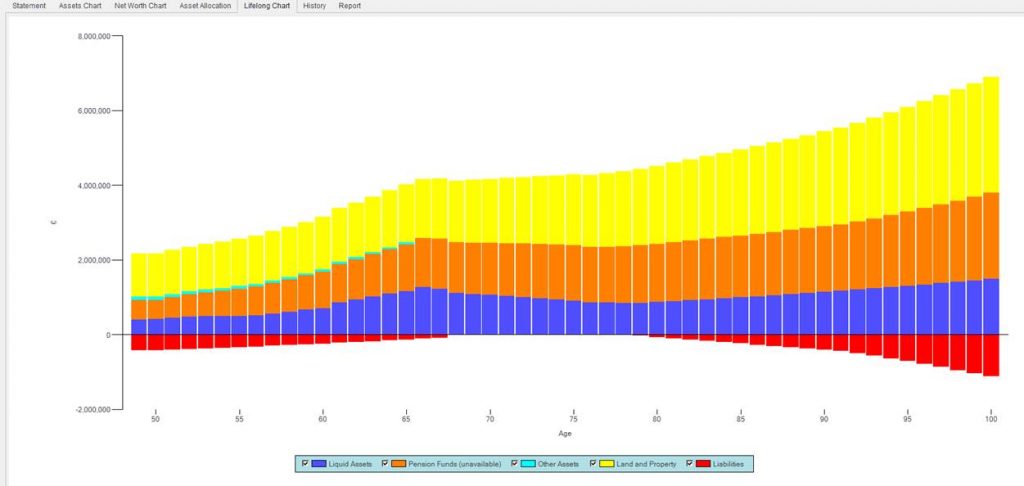

January: review your net worth and asset growth

Knowing your net worth is an increasingly popular way to understand how financially healthy you are. It will allow you to work out whether you are spending too much, how much you have in savings and whether you’re saving enough for retirement.

Net worth is simply the value of all your assets (what you own) minus all your liabilities (what you owe). There are many good reasons to calculate and keep track of your net worth, one of which is it will show whether you are making progress toward your financial goals. Knowing, tracking and regularly reviewing your net worth will make you more mindful of how you’re spending your money and put you in greater control of your finances.

In a similar vein, keep track of how your assets are growing in value over time. This simply means monitoring your investments such as a property you have purchased or any investment accounts you own. After all, you should be aware of where and how your assets are invested.

February: start getting ready for your tax declaration

Keeping your financial and tax affairs up to date will ensure you don’t fall foul of tax authorities in your country of residence and in your tax location. The amount of tax you must pay is regulated by your tax location, which isn’t always the same as your nationality. If you are unsure of your tax location, speak to one of our experienced tax partners.

While tax declarations aren’t due just yet, it’s wise to start getting your paperwork ready.

For UK expats

Unless you pay tax at the source – in other words, via your employer – you need to self-assess and declare your income to HM Revenues and Customs (HMRC).

Your Tax Return must normally be filed (completed and submitted to HMRC) by 31 October following the tax year end (5 April) if you file on paper, or by 31 January following the tax year end if you file online. Visit the UK Government’s website for further clarification.

For US expats

US citizens living abroad must pay US income tax on their worldwide income. The due date for filing a federal individual income tax return is generally 15 April of each year. As a US citizen living and working outside of the US, you may qualify for a 2-month extension until 15 June to file your return and pay any tax due. However, it’s best to check with Internal Revenue Service to be clear about your tax obligations and associated deadlines.

March: review your retirement savings

Regardless of whether you’re nearing retirement or just starting to plan your future, saving for later in life is essential.

There are different factors to consider such as your ideal retirement age and what exactly a ‘comfortable’ retirement means to you. Does it mean travelling the world or taking an early retirement and living a more modest lifestyle? Whatever you have in mind, you need to plan ahead and be honest with yourself about how much you need to save.

Being an expat can present an incredible opportunity to build personal wealth while working abroad. By putting aside regular amounts of money now, you can build your own form of pension-like savings without making too many sacrifices to your current lifestyle.

April: carry out a mini financial audit

Online and mobile banking make managing finances easy and convenient. There’s just one key thing to remember when banking online: security. While banks use various security measures to keep customers safe, it’s wise to do your own audit to keep your banking information safe. Use this time to change your passwords if you’ve been using the same ones for a long time. Enable two-factor or multi-factor authentication on your accounts where possible.

If you download apps to manage your banking, make sure you’re using the bank’s official app. And before downloading any financial app, it’s always wise to check ratings first and research whether they’ve had any data breaches.

As part of your mini financial audit, check that you have an up-to-date list of all your investments and savings. Do you need to chase your bank or investment providers for missing statements? At this point, it’s also a good idea to review your liquidity. Are you holding more or less cash than you expected?

If you have too much cash sitting in a low or no interest account, now could be a good time to move your money to make it work harder for you.

May: check your level of debt

To start, understand the difference between ‘good’ debt and ‘bad’ debt. Good debt, such as borrowing for further education or training, to buy property or to start a business, can increase your net worth. Bad debt is when you borrow money to buy something that doesn’t increase in value or generate income, such as a car, clothes or credit card debt.

If you are debt free, how can you increase your savings? If part of your motivation for getting out of debt was so you could start saving for a major purchase, such as buying property, it’s time to start making that dream a reality. Property can be a wonderful investment. It can provide a real sense of stability whilst offering a passive revenue stream if you choose to rent it out.

If you are paying down your debt each month, but your balance doesn’t seem to budge, make a plan to start reducing it. For example, pay the minimum on all of your debts each month except for the one with the highest rate. On that debt, pay as much as you can afford. Once this debt is eliminated, move to your next highest interest rate debt, paying more than the minimum. You continue this process until all of your debt is cleared.

If you’re dealing with multiple debts, consider debt consolidation or combining all of your debts into a single loan. This may allow you to pay off your debt with one monthly payment, which is often much lower than all of your previous monthly payments combined.

June: ‘sense check’ your emergency fund

If 2020 taught us nothing else, it’s the importance of having an emergency fund. Unforeseen events like a pandemic can create a sinkhole in your best laid financial plan.

If you don’t have 3–6 months’ worth of expenses set aside in case of an emergency, make it a priority. Knowing you have emergency cash can help ease your anxiety if you are faced with an unexpected change in circumstances, or even worse, job loss.

Having a safety net can also prevent you from spending your money on a whim. In other words, don’t use your day-to-day bank account for your emergency money as it will be far too easy to spend. By directing some of your pay into a separate account on a regular basis, you won’t be tempted to spend it. Just remember that your emergency fund should be used for what it says on the tin: emergencies only.

July: review your investments

When you’re moving around the world, it can be easy to lose track of what you have invested and where. With offshore investments you can easily stay on track so it shouldn’t be too difficult to review your portfolio.

If you don’t have any offshore investments, they are increasingly popular because they act as a geographically portable retirement plan. And, contrary to what is often reported, today’s offshore jurisdictions represent highly professional and regulated wealth management services.

The most popular form of offshore investment is an offshore investment bond. These are investment ‘wrappers’ set up by life insurance companies in which you can hold a wide range of funds covering different types of assets such as equities, fixed interest securities, property and cash deposits. Reviewing your investments is a key part of retirement planning, so it’s wise to make the time to look closely at what you have invested and where.

August: review your will (or make a will if you don’t already have one)

It’s not something any of us like to think about, but having a will is always a good idea. If you die without a will, your wishes may not be carried out. Even if you think you don’t have enough assets worth passing on, that could change in the future.

If you already have a will, you will certainly want to amend it as time goes on and your situation changes but getting something prepared now is always wise.

Have you thought about what would happen in the event of you falling ill and not being able to access your financial and other important information? Who would you trust to take care of financial matters on your behalf?

Ask yourself these questions and gather in one place all of your most important financial information, including your bank details, insurance policies and social security numbers (or your country equivalent). You should then share this with someone you trust.

September: check in with your dependents

Who is dependent on your financial situation? A partner or family member? If you’re in a relationship, do you talk openly about money? Do you care for older parents who need long-term care insurance?

Take time to review your situation to ensure your finances are in good shape to take care of them as well as yourself. For a long time, talking about money was seen as a ‘taboo’, especially with those closest to us.

However, it’s been proven that, while a lot of factors contribute to healthy relationships, money plays a key role. It follows that regularly talking about money with your loved ones and dependents opens conversations about financial needs, goals and decision-making.

October: review your insurance policies

Make sure your insurances are up to date and cover the right things should something unexpected happen. Insurance is a necessary evil, but you want to be completely protected.

Take the time to review the policies you do have, including travel and health insurance. It’s also worth reviewing all your policies at the same time as you may be able to save money on your premiums by taking advantage of any discounts, for example by bundling policies. Also, if you were a smoker when you purchased life insurance but have since given up, you may be able to get a better premium. Ask your insurance company how long you have to quit to be considered a non-smoker.

November: review your expenses

Be honest with yourself about what is a ‘must have’ and a ‘nice to have’ when it comes to purchases. The key to becoming a regular saver is making small changes that won’t impact your quality of life. Many people follow either extreme: not saving anything at all or sacrificing all treats and luxuries to save a lot. The best thing to do is to find a balance.

Have your expenses suddenly crept up or have you managed to reduce them? Could you make a lump sum investment or increase your regular savings? Re-prioritising your expenses by delaying certain purchases or purchasing lower cost alternatives will help you to become a regular saver without any significant impact on your lifestyle.

One of the best ways to track your spending is via an app. In the same way you might use a sleep tracker or fitness app, savings apps can help you understand how you currently manage money and make suggestions for how you can improve. Being able to track your spending will help you make better decisions and hopefully save more in the long term.

In addition to tracking spending, most apps come with features that allow you to actively plan your finances, such as setting budgets in different currencies, which is a great feature for expats.

December: celebrate how much you’ve achieved!

The end of the year is the perfect time for taking stock. If your financial health is in good shape, congratulations! Reward yourself by spending some of your savings if you’re in a position to do so.

As well as saving for your future it’s important to also enjoy the fruits of your labour. Most of us find it tough to continually strive toward a goal without any reward. The same can be said for saving. Just remember to always balance living today with planning for the future.

And if your financial health still needs attention, at least you know where you need to concentrate your efforts in the coming 12 months.