When moving to Spain there is a lot to consider, and many people want to ‘test the water’ a little before committing to that long term move… this was much easier to do pre BREXIT for the British among us! Applying for residency was almost just a paper exercise without all the various requirements and hoops to jump through that we have now. In fact, pre BREXIT I regularly came across retired expats with a foot in each country … declaring UK tax residency, keeping their UK home whilst spending most of their time in Spain … those days are gone and now it’s crucial to get the timing right if you do intend to make that move and eventually sell your home outside of Spain! Here is my checklist of things to consider in respect of timing the sale of your main home:

When moving to Spain there is a lot to consider, and many people want to ‘test the water’ a little before committing to that long term move… this was much easier to do pre BREXIT for the British among us! Applying for residency was almost just a paper exercise without all the various requirements and hoops to jump through that we have now. In fact, pre BREXIT I regularly came across retired expats with a foot in each country … declaring UK tax residency, keeping their UK home whilst spending most of their time in Spain … those days are gone and now it’s crucial to get the timing right if you do intend to make that move and eventually sell your home outside of Spain! Here is my checklist of things to consider in respect of timing the sale of your main home:

– The tax year in Spain, which runs 1 January to 31 December, not April to April as in the UK.

– Once you become Spanish tax resident you pay tax on your worldwide assets, not just your Spanish assets.

– As a Spanish resident, the Hacienda will view your main home as your Spanish home, after all, that’s the address you’ve registered that you are living at (whether it’s rented or owned is irrelevant), it’s your family base.

– If your Spanish address is your main home, by default any other property becomes a second home/holiday home and capital gains tax becomes payable on the profit made on the sale of that second home, with no ‘time apportionment’ relief (ie; no reduction in the tax payable even though you may have actually lived in that home for many years as your main residence prior to moving to Spain).

How much is the tax payable if your home outside of Spain is deemed to be your second home?

How much is the tax payable if your home outside of Spain is deemed to be your second home?

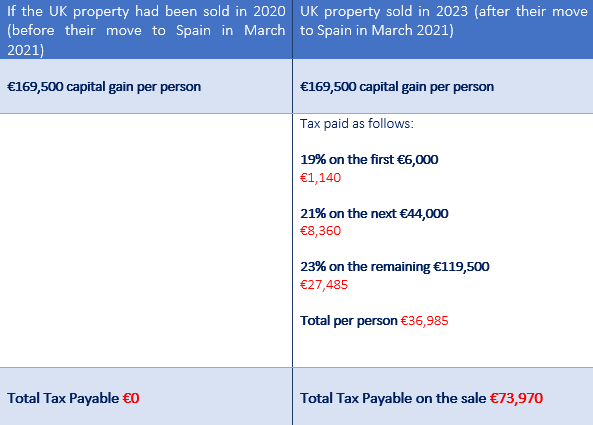

Capital gains tax is payable to the Hacienda at 19% on the first €6,000, 21% on the next €44,000, 23% on the next €150,000 and 26% on the remainder.

It is considerably more advantageous to sell your property outside of Spain before you are deemed Spanish tax resident.

Let’s work through two scenarios, first selling before being considered Spanish tax resident and the difference if selling after becoming Spanish tax resident:

Paul and Sarah bought their UK property in 1998 for £250,000. They lived there happily until their move to Spain in March 2021. In April 2023 they decide that Spain is definitely where they want to be long term.

They rented their UK property out when they moved and unfortunately they’ve had a bad experience with tenants, who have not paid the rent regularly and have caused additional maintenance work … all in all despite offering a solution to bring in income during and after their move, renting the UK property has not proved successful so they’ve decided to sell and invest the proceeds into a Spanish Compliant Investment which can provide a regular, more tax efficient income moving forward with a lot less stress! The sale price is £550,000, so £300,000 profit.

The UK property is jointly owned so the profit is divided by two and taxed as follows by the Hacienda:

– £300,000/2 = £150,000 capital gain per person

– £150,000 converted to euros @1.13 exchange rate = €169,500 gain per person

TIEs

TIEs

If you are first time resident in Spain you will have a TIE card that expires in 5 years, if you were already deemed resident in Spain prior to obtaining your TIE, your TIE card will have a 10 year expiry date. Typically (although I hasten to add not always) your first day of residency can be taken as the date from which your TIE card starts. So the timing of the sale of your home outside of Spain is crucial if you want to avoid the capital gains tax.

When should I sell my home outside of Spain?

When should I sell my home outside of Spain?

To me it makes sense to keep the move as clean and simple as possible in respect of the Hacienda and avoid selling in the calendar year that your residency starts if possible. Technically speaking, if your residency starts on 1 September you have lived in Spain less than six months that tax year, so you SHOULD be able to sell your home outside of Spain in that year without paying capital gains tax in Spain.

However, if you want to ensure that the sale is not questionable in any way, it would be prudent to sell it in the calendar year before you make the move. That keeps it totally out of the equation with no issues.

There are all kinds of things to think about when deciding to live in Spain, when to sell your home outside of Spain is just one. It’s important to get advice specific to your particular situation before you move and ongoing advice after making the move, as guidelines and rules can change. How you hold your assets, and as we can see above, the timing of any sale, can have a big impact on the tax you pay in Spain.

This article was kindly provided by Andrea Speed from Speed Financial Services and originally posted at: https://www.speedfinancialsolutions.com/post/selling-your-home-outside-spain-and-want-to-avoid-capital-gains-tax-in-spain

The above contents and comments are entirely the views and words of the author. FEIFA is not responsible for any action taken, or inaction, by anyone or any entity, because of reading this article. It is for guidance only and relevant professional advice should always be taken before investing in any assets or undertaking any financial planning.