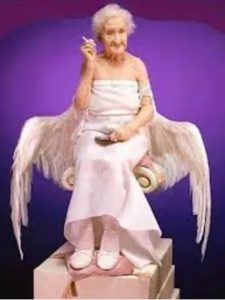

People in France will remember the summer of 1997 for the deaths of Princess Diana, Mother Teresa, and Jeanne Calment. The first, as we know, became a household name by marrying into royalty; the second, by caring for the world’s sick and poor. Jeanne Calment, however, was an accidental icon. For a hundred and twenty-two years, five months, and fourteen days, Calment managed not to die. When she was 85, she took up fencing, and still rode her bike when she reached 100. At the age of 114, she starred in a film about her life, at age 115 she had an operation on her hip, and at age 117 she gave up smoking, having started at the age of 21 in 1896. Interestingly, she didn’t give up for health reasons; her reason was that she didn’t like having to ask someone to help her light a cigarette once she was nearly blind!

People in France will remember the summer of 1997 for the deaths of Princess Diana, Mother Teresa, and Jeanne Calment. The first, as we know, became a household name by marrying into royalty; the second, by caring for the world’s sick and poor. Jeanne Calment, however, was an accidental icon. For a hundred and twenty-two years, five months, and fourteen days, Calment managed not to die. When she was 85, she took up fencing, and still rode her bike when she reached 100. At the age of 114, she starred in a film about her life, at age 115 she had an operation on her hip, and at age 117 she gave up smoking, having started at the age of 21 in 1896. Interestingly, she didn’t give up for health reasons; her reason was that she didn’t like having to ask someone to help her light a cigarette once she was nearly blind!

Recently reading about this fortunate woman led me to google average life expectancy for each country, here are the top 35 countries:

https://www.worlddata.info/life-expectancy.php#by-population

Hong Kong offers the best life expectancy of 82.9 for men and 88.0 for women, whilst, as a result of living conditions of a person/population group Western Africa comes in at a low of 56.07 for men and 58.04 for women. Essential factors are medical care, balanced nutrition and drinking water supply. These factors are influenced significantly by political factors, which is why life expectancy often derives from a country’s standard of living, not just climate, particularly if you consider the likes of Iceland and Norway appearing in the top 5! A fish-heavy diet full of heart healthy Omega-3 fatty acids together with low pollution has been cited by some as major contributory factors to the secret of longevity for people in these colder countries.

In the vast majority of countries, women are four to eight years older than men. According to many scientists, this is not a purely biological difference. Instead it is also attributed to different behaviours. According to this view, men are less careful about their bodies than women. In fact, smokers and alcohol consumers are more common among men. Also, physical stress with simultaneous aversions to medical treatment and health precautions are responsible for this. The women reading this article may be peering over their glasses at their other half if their experience is similar to mine in respect of the men in their life … I’ve found that they rarely visit a Dr unless they are pushed into it and there’s no sign of this changing as my 31 year old son is the same! Men take note!

But what has this got to do with Sun, Sea and Sangria, or your finances?

One thing is for sure, whichever article I read, one country that is always very popular for Brits to retire to is Spain. It always appears within the top 5 countries as a retirement location for various reasons, the climate, the close proximity to the UK which is ideal for family get togethers, the health system (it ranks higher than the UK) and the lifestyle. The thought of a better lifestyle and weather, coupled with a cheaper way of life drives many over 50s to have a desire to extend the dream holiday to a permanent situation. The cost-of-living crunch, if anything, has made it more likely people will jump ship from the UK. But there’s much more to making that move that I advise people to consider …

Make sure your finances are set up in the best way for your life in Spain

Here’s a bullet point list of things to consider and take advice on:

Here’s a bullet point list of things to consider and take advice on:

-

The tax year (in Spain it runs from January to December not April to April). This may have an impact on your finances when making the move initially, dependant on how your income is made up and may require careful planning to avoid paying too much tax. (I am a qualified tax specialist).

-

UK State Pension (have you obtained your UK State Pension forecast?) It may be worth considering voluntary contributions if you have not qualified for a full UK State Pension.

-

Private Pension (how to reduce your income tax liability down to 3% marginal rate, avoid a lifetime allowance charge, avoid the pension becoming taxable on your beneficiaries in the event of your death after age 75, and finally avoid Spanish Inheritance Tax). Private pensions are a complex area that I recommend you take specialist advice on. (I am a qualified pension specialist).

-

Previous Company Pension (a traditional defined benefit pension scheme offers fantastic benefits including a guaranteed income for life, but if you’re divorced with no children or adult children there will be no fund or ‘pot’ to pass on to your new partner or preferred beneficiaries). This may not be an issue for you, but if it is, or if you are not reliant on the guaranteed income it may be worth reviewing your options. Some people prefer to have more control and flexibility. Again, this is a complex area that I recommend you take specialist advice on. (I am a qualified pension specialist).

-

ISAs (ISAs are not tax efficient in Spain). Any growth achieved on an ISA as a Spanish resident must be declared on your Spanish Tax Return, whether you withdraw the growth or not! The growth is added to your income for the year. There are alternatives available to you as a Spanish resident that are very tax efficient, with no tax paid on the growth each year along with other benefits, such as no Spanish Inheritance Tax payable on first death. Spain does not automatically offer the free transfer of assets between spouses on death so it is important that you do not leave yourself or your loved one unnecessarily exposed. (I am a Qualified Investment and Risk Specialist).

-

Any other investments and savings held outside Spain that are not specifically Spanish Compliant (there are a number of issues here but I’ll try to cover the main ones). If these assets have a value of over €50k euros per person you will need to complete a Modelo 720. The information on the Modelo 720 is typically used to assess your assets for Spanish Inheritance Tax on death. As with ISAs, any growth achieved on your savings and investments as a Spanish resident must be declared on your Spanish Tax Return, whether you withdraw the growth or not! The growth is added to your income for the year. As mentioned above, there are alternatives available to you as a Spanish resident that are very tax efficient, with no tax paid on the growth each year along with other benefits, such as no Spanish Inheritance Tax payable on first death. (I am a Qualified Investment and Risk Specialist).

-

Bank Accounts Outside Spain (your bank may ask you to close your account). Since BREXIT some banks do not have a license to operate in Spain. Other issues include a worldwide requirement for financial institutions to share information, called the Common Reporting Standard. I recommend you take advice in respect of your bank accounts as once a year information will be shared with the Hacienda (the Spanish Tax Authority).

-

Bank Accounts in Spain (keep the amount held in a Spanish bank account to a minimum). Something we never need to consider with our UK bank accounts but definitely need to be aware of with a Spanish bank account, is that there are circumstances when should the Hacienda believe you owe money, or should you not pay a speeding fine for example, they are legally allowed to ‘embargo’ (take money) directly from your Spanish bank account. The onus is on you to demonstrate to them why they should not have done so rather than on the Hacienda to explain why they were right to do so – beware!

-

Making a UK and Spanish Will (make a Will in each country but make sure that one does not cancel the other). This is a complex area, but broadly if you die without making a Will in Spain your assets will be dealt with under Spanish Law. This means that your spouse will not automatically inherit your estate, as in Spain children are automatically included in set percentages. Your spouse may have a right to live in the property that you own until their death, but they will not automatically inherit your share.

This list is not exhaustive and each individual clients’ circumstances are different when it comes to providing financial advice that future proofs you as much as possible. As you can see, there’s a lot to think about, but by ensuring you have received the right advice for your own situation, you should be able to kick back and enjoy some sun, sea and sangria!

This article was kindly provided by Andrea Speed from Speed Financial Solutions and originally posted at: https://www.speedfinancialsolutions.com/post/sun-sea-and-sangria-the-secret-to-longevity

The above contents and comments are entirely the views and words of the author. FEIFA is not responsible for any action taken, or inaction, by anyone or any entity, because of reading this article. It is for guidance only and relevant professional advice should always be taken before investing in any assets or undertaking any financial planning.