With the UK likely to leave the EU in 2019, many people are making the move and leaving the UK whilst it is arguably still easier to do so than it will be after Brexit. But what are the key things you need to do in order to be organised from a personal financial advice point of view? Here I have listed my ‘Top Tips on moving to Spain’, the main areas I point people in when making the move, or having just arrived in Spain. This could save you a lot of time, money and headaches, and is only a small example of the way I help clients living here in Spain.

- Confirming Non UK Resident Status with the HMRC

- Potential Tax Rebate

- National Insurance Contributions Whilst Abroad

- Checking Your National Insurance Contributions

- Becoming Tax Resident in Spain

- Existing Investment Organisation

- Inheritance

- Healthcare

- Life Insurance

- Wills

- Property

- Private Pensions

- Banking

- Why Move to Spain Before Brexit

Confirming Non UK Resident Status with the HMRC

Tell the HMRC that you will no longer be a UK resident by filling in form P85, informing your local council and the UK state pensions department. This is important for the following reasons:

Potential Tax Rebate

In many cases you could receive a tax rebate, depending on which part of the tax year you leave in. Tax is taken from your wages and worked out on what you are paid each month, starting with the first month. Therefore, if your final UK salary payment is in September having been earning £4,000 per month, for example, that means the following months until the end of the tax year, in March, you won’t be paid anything. Therefore, because the HMRC would have been taxing you on the basis of completing that financial year, the tax you owe could well be reduced and in many cases a rebate will be applicable.

National Insurance Contributions since abroad

You can apply for Non Resident relief when living abroad, meaning that you can pay National Insurance contributions in the UK at half the cost, so around £11 per month (which mathematically is worth doing, considering life expectancy in Europe of 84). You can also backdate these up to 6 years if you have been out of the UK that long and haven’t been paying.

www.gov.uk/national-insurance-if-you-go-abroad

Checking your National Insurance Contributions

You can see how many years National Insurance contributions you have by entering your number on the link below:

www.gov.uk/check-national-insurance-record

Becoming tax resident in Spain

It is important that when you move to Spain you choose the right tax regime to be part of. For example, if you are working for a Spanish entity, you may be able to apply for The Beckham Law, which means all worldwide income will be taxed for 5 complete tax years at least, at a flat rate of 24% (as opposed the normal rate of up to 46%).

Or, if you live in Spain, work for a Spanish company and spend up to two weeks of the month outside of Spain on business, you may be able to deduct tax for every day you are away proportionally. So, that could mean up to half the tax payable.

IMPORTANT – Some of these tax regimes only give you a limited time to apply for them. For example, within 6 months of paying tax here you have to apply for the Beckham Law.

It may also be of benefit to set up a Spanish company instead of becoming self employed, the main rule of thumb here being if your income is likely to be consistently over €60,000 per annum.

Existing investment organisation

Any investments you have when you become tax resident in Spain (that is, spending more than 6 months a year in Spain and having your economic centre of interests there being the deciding factors) will be reportable in Spain and might not be as tax efficient as they should be. For example, many asset classes such as ISAs or stock/share/fund investments (unless structured in a certain way) are declarable each year and tax is payable on any gains, whether you take any of that money or not. In some cases, you can have your assets organised so this is not the case, and the tax can potentially be reduced when you do withdraw any money.

Inheritance

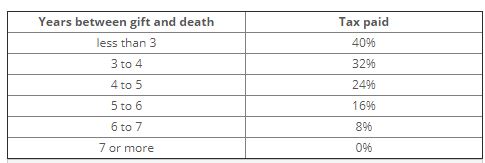

In Spain, rules on giving away your assets are very strict and you are limited in what you can give away per year without incurring any tax. This is an area that is worth considering and organising before you leave the UK. In the UK there is usually no inheritance tax to pay on small gifts you make out of your normal income, such as Christmas or birthday presents. These are known as ‘exempted gifts’. There’s also no inheritance tax to pay on gifts between spouses or civil partners. You can give them as much as you like during your lifetime, as long as they live in the UK permanently. However, other people you gift to will be charged inheritance tax if you give away more than £325,000 in the 7 years before your death. See the sliding scale below:

In Spain, gift tax depends on the age of the person and their relationship to you. In many circumstances you receive a €100,000 exemption, following which a sliding scale up to 20% is applied in tax. Spouses can claim up to 99% relief. It is imperative to look at this before you move.

When you first arrive in Spain, registering at your local health centre should be a priority in case of illness. The requirements can change, but at present the following should be sufficient for you to acquire an individual health card (Tarjeta Sanitaria). This will enable you to register with a doctor, visit a health drop in centre (in Barcelona a Capsalut) and purchase prescription drugs:

- NIE (tax number/residence certificate)

- Rental contract of your apartment

- Social Security number

- Empadronamiento (document from the town hall confirming where you live)

Life insurance

When you first arrive in Spain, registering at your local health centre should be a priority in case of illness. The requirements can change, but at present the following should be sufficient for you to acquire an individual health card (Tarjeta Sanitaria). This will enable you to register with a doctor, visit a health drop in centre (in Barcelona a Capsalut) and purchase prescription drugs:

If you have questions relating to these points, or anything similar, don’t hesitate to get in touch.

The above article was kindly provided by Chris Burke from The Spectrum IFA Group and originally posted at: https://www.spectrum-ifa.com/tips-on-moving-to-spain-before-brexit/