Early Retirement Pensions in Spain

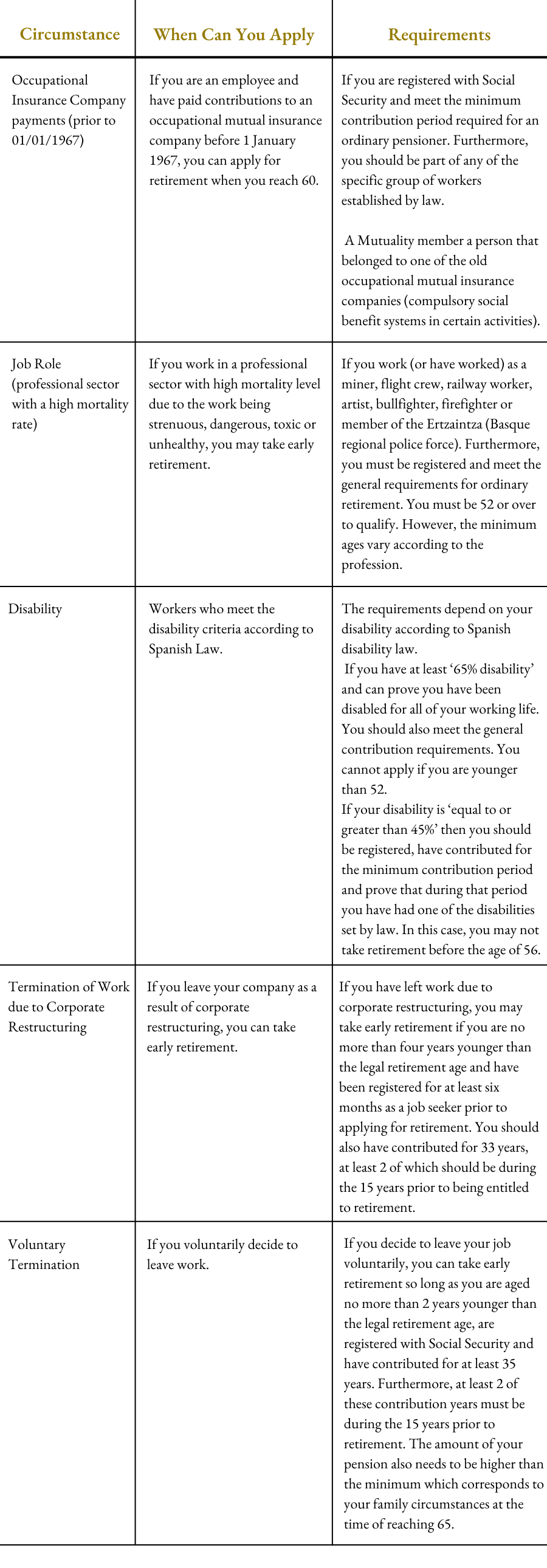

Did you know that in Spain, under certain circumstances, you can take early retirement before the legal retirement age? But what are these circumstances and what requirements must you meet?

What are you entitled to and how can you apply for it?

This can be quite complicated depending on your situation, and we would recommend taking professional advice so that you can be sure of exactly what you are entitled to.

New Cryptocurrency Regulations in Spain

From 2023 onwards, Spanish residents will have to declare cryptocurrency holdings in their tax returns. Currently, cryptocurrency holders are only obliged to declare any profits or losses in their income tax returns. The 2022 tax return has a special section for these assets. However, from 1st January 2023, a new regulation will be implemented meaning that all Cryptocurrency transactions must be declared. This has been regulated by Spain’s new anti-fraud law, which is currently at the public hearing stage. It has been set out in a draft bill incorporating several anti-fraud amendments.

The new tax declaration will have to be submitted using the form Modelo 721. Information will have to be included on those who have held cryptocurrency or have been authorised beneficiaries of cryptocurrency at some point during the year (from 2023 onwards). Furthermore, cryptocurrency holders will have to include information on what their final balances are at the end of the year, as well as information on the types of cryptocurrency and the amount of units that they hold, along with the equivalent amount in Euros. This new regulation further reinforces the need to seek professional tax advice if you are a cryptocurrency holder or thinking of becoming one.

The above article was kindly provided by Chris Burke from The Spectrum IFA Group and originally posted at: https://spectrum-ifa.com/top-tips-for-expat-finances-in-spain/