Perhaps you’ve just started your life as an expat, or you may have been living and working abroad for years. Regardless of where you are on your journey we are confident that the tips below will help you take a few extra steps towards securing your financial future.

Expenses review

Before deciding how much you can save and direct toward your financial goals, you need to know how much you’re spending. Make it a habit to regularly review your spending. An honest appraisal of how much you spend is the best way to start assessing where you’re at financially. There are often forgotten expenses such as subscription services and gym memberships that are easy to cut.

Apps to track

We are never far away from our phones, so one of the best ways to track your spending is via an app. Savings apps can also help you understand how you currently manage money and make suggestions for how you can improve. Being able to track your spending will help you make better decisions and hopefully save more in the long term. Most apps also come with features that allow you to actively plan your finances, such as setting budgets in different currencies, which is a great feature when you travel regularly and perhaps have income and expenses across different countries. Some of the best and most intuitive money management apps we’ve come across include Good Budget, You Need a Budget, Wallet, Joy, Mint and Albert. However, whichever app helps manage your finances, the main objective is developing and sticking to good habits related to money management and savings.

Wants and needs

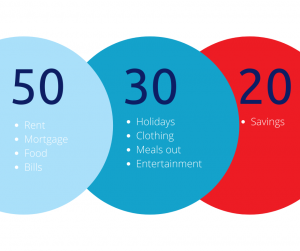

There are things you need, like food, accommodation and clothing, while others you just want, like the latest smartphone or designer watches. To start your evaluation, write a list of everything you spend money on and divide the list into needs and wants. Once you tally the totals, calculate the percentage of each. The popular ‘50/30/20 rule’ is an easy budgeting method that can help you to manage your money effectively. The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants, and 20% for savings, or paying off debt. By keeping your expenses balanced across these three main categories, you’ll be wiser about your spending habits, and avoid overspending. And with only three major areas to track, it will be easier to stay on track to reach your financial goals.

Set a savings goal

After learning how to manage your money and track your spending, set some financial goals. Think about setting goals specifically related to your personal circumstances. If you don’t have anything specific in mind, you will find it difficult to motivate yourself to keep saving and investing every month. Take the time to set realistic financial goals. Don’t have your goals written down? Take the opportunity to do it now as it will help to give you some sense of control over your financial situation. Having everything written down in a documented financial plan will help you to avoid making fear-based decisions. It will also help you to measure your progress over time and keep you on track when you’re working toward a long-term goal like buying property or starting a business when you move back onshore. The only ‘right’ time to start saving is now. Regardless of how much you can save every month, saving regularly is key to building your personal wealth. One of the most important things you should do as part of your savings plan is build your emergency fund. As well as acting as a financial safety net, an emergency fund can prevent you from spending your money on a whim and instead help you build savings easily without noticing. Therefore, don’t use your day-to-day bank account for your emergency money. Also, consider whether you can commit to a longer term, regular savings plan. Committing to a regular savings plan essentially means agreeing to tying up your money for a period of anywhere from 5 to 20 years. As with any finance-related decision, there are pros and cons of committing to a regular savings plan.

Make compound interest work for you

Compound interest refers to a method of continually reapplying interest to a principal (the original sum of money put into savings or an investment) that is growing over time. This calculation of interest is present on virtually all credit card and loan payments where a debt grows with each unpaid billing cycle. That’s when compound interest works against you. However, it can work to your advantage when applied to your savings or investments. Put simply, compound interest is interest on interest, which is a powerful financial force when allowed to accumulate over a long period of time. Compound interest puts your hard-earned money to work and grows larger as it feeds on itself.

Get a buddy

Ever noticed how much easier it is to achieve your fitness goals when you agree to meet a friend for a workout? The same principle can apply to your finances. If you have a reliable and trustworthy friend or family member you know can help you reach your financial goals, make them your savings buddy. Sharing your savings goals with people you trust can help keep you accountable and increase the chance of you reaching those goals. It could be as simple as sharing that you want to save €5,000 in the next six months. To do that, you need to save €200 a week. Every week, you check in to confirm whether you put the money aside. If you didn’t, you will soon realise that it’s easier to save the money than admit to spending and not achieving your goal! In yachting, it’s especially easy to be pressured into spending when your expenses are low and cash flow is high. Having someone who understands what you want to achieve will help curb the temptation to constantly spend and also make you feel less alone in your efforts.

Change your credit card

If you owe a large amount on a high-interest credit card, it will be more challenging to pay it off quickly. Monthly charges can eat into your minimum payment, so you see only small, incremental changes. Try asking your bank or credit card provider for a lower interest rate or look at transferring the balance to a low-interest rate credit card. A few months of interest-free payments may be all it takes to pay off your balance, which means you can redirect that money towards your savings. If it’s not possible to switch cards, pay as much as you can every month. That is, always try to pay more than the minimum monthly amount if you want to make real progress towards paying off high-interest debt.

Watch bank interest rates

Whether you’re borrowing or saving, interest rates can be confusing but the most important thing to know is that even a small change in interest rates can have a big impact. It’s important to keep an eye on whether they rise, fall or stay the same. More importantly, understand how a change in interest rates could impact your savings and loans.

Pay off your debt

This is one of the most important things to do to get ahead financially. List all of your current debts, including credit cards and personal loans, and work out the minimum amount you must pay. Then evaluate your expenses and determine how much more you could pay towards repaying your debts. If you’re paying only the minimum amount every month, it will take you much longer to clear your debt. Also try consolidating multiple debts into one and always look at your spending habits and adjust them if necessary, to pay off debt as quickly as possible.

Review assets and liabilities

An increasingly popular way to understand how financially healthy you are is to know your net worth. Net worth is simply the value of all your assets (what you own) minus all your liabilities (what you owe). Assets include everything from cash, money in your savings accounts to vehicles and property. Liabilities include any money you owe in the form of loans, credit card debt or mortgages. In theory, your net worth is the value in cash you would have if you were to sell everything you own and clear your existing debt.

Build a passive income

There are two main ways to making money: earning it actively by working for a salary or earning it passively, by saving or investing in stocks, real estate or other savings vehicles such as investment platforms. To help secure your financial future, look for opportunities to generate income on the side. Passive income from a rental property is another way to build wealth or find extra money to help pay off debt.

Contribute towards your pension

Regardless of whether you’re nearing retirement or just starting to plan your future, saving for later in life is essential. It makes good financial sense to think carefully about what you wish to do once stop working. It might be that you have a good company pension with matched contributions. If this is the case you definitely want to take advantage and build this up over time. Each country is different but there will often be tax advantages towards pension contributions, such as Swiss Pillar 3 or the 401K in the States. Take the time to research what is available to you and what impact there is on your savings should you leave the country in the future. There are a few different factors to consider such as your ideal retirement age and what exactly a “comfortable” retirement means to you when you’re back on shore. Whatever you have in mind, you need to plan ahead and be honest about how much you need to save. This is especially important if you won’t qualify for a state pension and need to fund 100% of your retirement through company and personal investment.

Get covered

Protect your finances by having insurances in place and ensure they cover the right things should something unexpected happen. When it comes to onboard accidents and illness, what you’re covered for varies depending on the conditions stipulated in your contract. Your employer may not always provide health insurance and, if so, their policy may not offer cover during probationary periods. Always review your contract carefully. If you own property, make sure you have the appropriate homeowner’s insurance and renter’s insurance if necessary. A surprisingly high number of people are tempted to skimp on insurance but keep in mind that having it protects you from potential catastrophes that can create a sinkhole in the best laid financial plan.

Leverage exchange rates

Currencies continuously fluctuate and if you can secure a good exchange rate, you will make your cash go a long way. To get the best rates while abroad, be sure to always use credit and debit cards that do not charge an international transaction fee. If your credit card has no international transaction fees, paying in the local currency can give you the best exchange rate at the point of purchase without additional hidden fees tacked on. If you’ve decided to use an online bank account there is often an FX option tied in. If you are purchasing property or transferring large sums of cash then it may be worth using a broker or negotiating with your bank to secure the best rate. Even if the rate isn’t favourable, having a secured rate can prevent surprises on the day of exchange should the rate suddenly drop. You don’t want to be caught short when exchanging property contracts for example.

Does DINK apply?

When you have a higher disposable income it’s easy to fall into the trap of spending more than you save. Nothing should prevent you from enjoying what you earn but just make sure you aren’t frittering it away at the expense of saving for your future. It’s about making the right decisions today that develop healthy savings and investment habits. If you are a DINK (Double Income No Kids), you are part of a group that has the biggest propensity to save and explore more investment opportunities. Perhaps you could even live off one income and save the other. The so-called ‘50% lifestyle’ has become popular with those who have the financial flexibility to support it. It isn’t a solution for every couple, but it’s a method of re-organising spending and saving that’s growing in popularity.

FIRE community benefits

There’s a growing movement of people who are practicing FIRE (Financial Independence Retire Early) principles and retiring up to 10 years earlier than traditional retirement age. Some refer to FIRE as the ‘ultimate life hack’. Ambitious, often middle-income earners are using the following formula to reach financial independence sooner: high savings rates (50–70% of their incomes) + frugal living (minimalism) + low-cost stock index fund investing. While not everyone who follows the formula embraces traditional retirement, the milestone for having reached financial independence is the moment when what they earn from investments pays for their expenses. According to FIRE adherents, when you hit that tipping point, the choice to work or not is yours and you are in control of how you spend your time.

Improve your financial knowledge

Understanding your finances seeps into every area of your life regardless of whether you think it does or not. That’s why it’s important to understand things like personal finance, borrowing, saving and investing. Being financially literate allows you to make more informed decisions and manage your money more effectively. Learn as much as you can about things like credit, saving and investing, which will also help you to become. Also, the disciplined about your money habits and make decisions about your future.